Nigeria’s evolving tax landscape has changed how businesses must document transactions, report revenue, and manage compliance. In this new environment, adopting the right invoicing practices for Nigerian businesses is no longer optional—it is essential for survival, growth, and credibility.

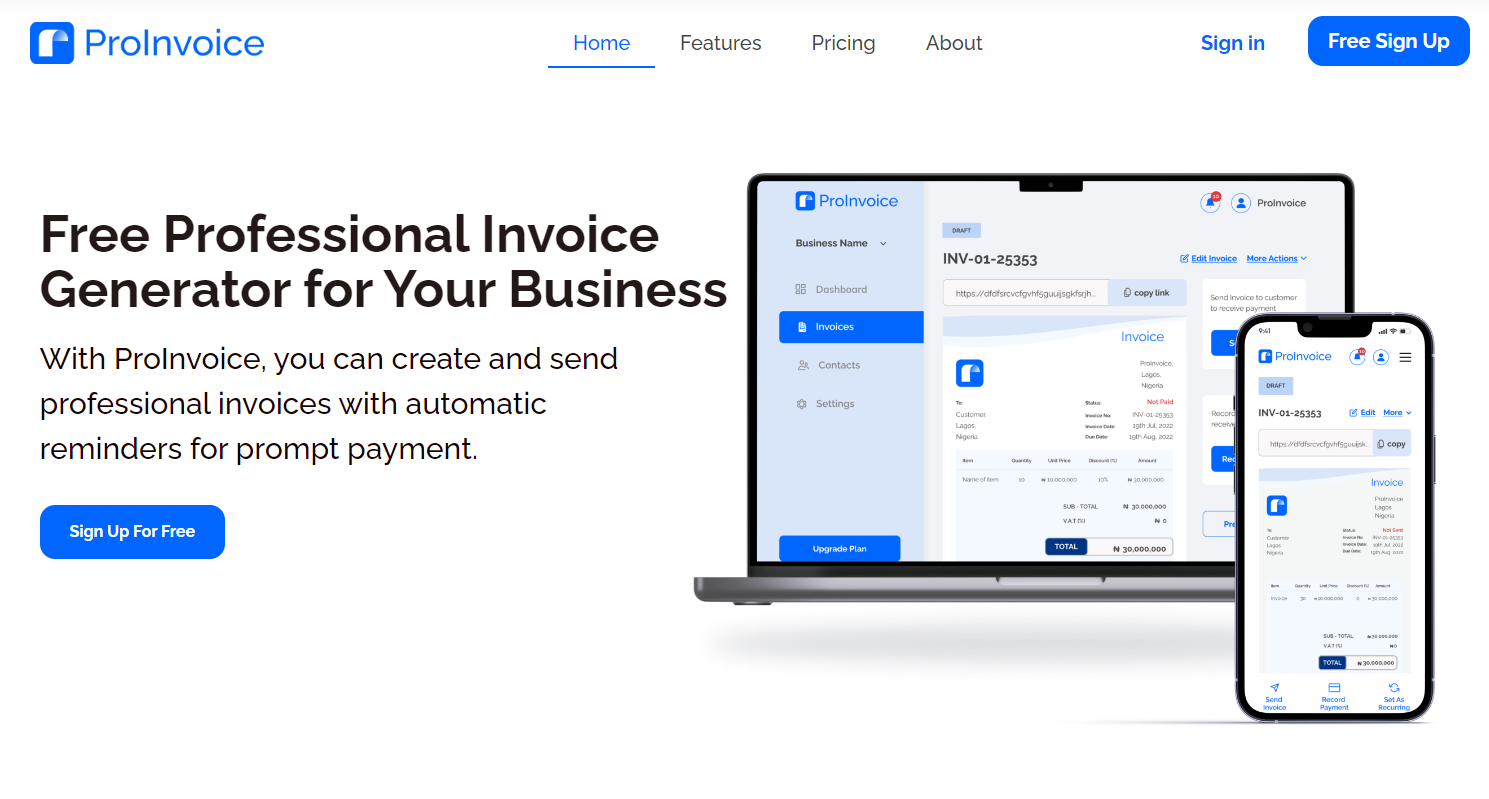

As tax authorities increase enforcement and digital reporting becomes more common, businesses must move away from informal billing methods. Fortunately, modern invoicing platforms like ProInvoice make it easier to issue compliant invoices, track payments, and stay aligned with regulatory expectations.

In this guide, you’ll learn the best invoicing practices Nigerian businesses should adopt in the new tax era, and how digital tools can simplify compliance while improving cash flow.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Understanding Nigeria’s New Tax Era

Nigeria’s tax system is gradually shifting toward greater transparency, digital reporting, and accountability. As a result, businesses are expected to:

- Keep accurate transaction records

- Issue proper invoices

- Track VAT and other applicable taxes

- Maintain audit-ready documentation

Without proper invoicing systems, many businesses risk penalties, disputes, and lost opportunities.

This is where ProInvoice becomes a critical business tool rather than just an admin solution.

Why Invoicing Practices Matter More Than Ever

Poor invoicing affects more than just payments. It impacts:

- Tax compliance

- Business credibility

- Access to funding

- Audit readiness

By improving invoicing practices, Nigerian businesses gain better control over finances and reduce exposure to compliance risks.

Use Proper, Structured Invoices

In the new tax era, handwritten or informal invoices are risky. Businesses must issue structured invoices that include:

- Business name and contact details

- Client information

- Invoice number

- Invoice date

- Description of goods or services

- Subtotals and totals

- VAT where applicable

Using ProInvoice ensures every invoice follows a consistent and professional structure.

Apply VAT Correctly and Transparently

VAT compliance is one of the most critical invoicing practices for Nigerian businesses.

Invoices should:

- Clearly show VAT amounts

- Separate taxable and non-taxable items

- Reflect accurate totals

Errors in VAT invoicing can lead to penalties and disputes. If you need a quick, compliant setup, free invoice templates from ProInvoice help businesses get it right from the start.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Assign Unique Invoice Numbers

Unique invoice numbers are essential for:

- Tracking transactions

- Supporting audits

- Preventing duplicate billing

Manual numbering often causes errors. However, ProInvoice automatically generates unique invoice numbers, eliminating this risk.

Set Clear Payment Terms on Every Invoice

Clear payment terms reduce late payments and disputes.

Invoices should state:

- Due date

- Accepted payment methods

- Late payment conditions

With ProInvoice, payment terms are standardized across all invoices, ensuring consistency and clarity.

Maintain Complete Invoice History

In the new tax era, invoice history is critical. Authorities may request past records during audits or reviews.

Proper invoice history helps businesses:

- Prove income

- Reconcile taxes

- Resolve disputes

Using ProInvoice, all invoices are stored digitally and securely, making retrieval effortless.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Automate Invoice Tracking and Follow-Ups

Manual tracking leads to missed invoices and delayed payments.

Automation helps businesses:

- Monitor invoice status

- Identify overdue payments

- Send reminders automatically

With ProInvoice, tracking and follow-ups happen without constant manual effort.

Use Digital Invoicing Instead of Paper

Paper invoices get lost, damaged, or forgotten. Digital invoicing offers:

- Better security

- Faster delivery

- Easy backups

The free invoice generator allows Nigerian businesses to create digital invoices instantly without technical stress.

Separate Business and Personal Transactions

One major compliance mistake is mixing personal and business finances.

Best practice includes:

- Issuing invoices only for business income

- Keeping business records separate

- Maintaining clean financial trails

Using ProInvoice supports professional separation and cleaner reporting.

Track Client Payment Behavior

Not all clients pay on time. Invoice history reveals patterns that help businesses:

- Adjust payment terms

- Decide which clients to prioritize

- Reduce bad debts

With insights from ProInvoice, Nigerian businesses can make smarter credit decisions.

Prepare for Audits Proactively

Audits are less stressful when records are organized.

Good invoicing practices ensure:

- Complete transaction history

- Clear tax documentation

- Faster responses to audit requests

Digital records stored in ProInvoice keep businesses audit-ready at all times.

Use Mobile Invoicing for Flexibility

Many Nigerian entrepreneurs work on the move. Invoicing should not wait until they return to the office.

The ProInvoice mobile app allows businesses to:

- Create invoices anywhere

- Send invoices instantly

- Track payments in real time

This flexibility supports faster billing and improved cash flow.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Improve Professional Image with Branded Invoices

Professional invoices build trust with clients and partners.

With ProInvoice, businesses can:

- Use branded invoice designs

- Maintain consistency

- Enhance credibility

Professional presentation matters more in the new tax era.

Reduce Errors with Automation

Manual invoicing increases errors, especially as transaction volume grows.

Automation:

- Prevents calculation mistakes

- Reduces duplicate entries

- Improves accuracy

This is why growing Nigerian businesses rely on ProInvoice instead of spreadsheets.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Use Invoice Data for Business Decisions

Invoices contain valuable insights. Reviewing invoice data helps businesses:

- Forecast revenue

- Plan expenses

- Identify growth trends

With built-in reports from ProInvoice, decision-making becomes data-driven.

Real-Life Example: A Nigerian SME Adapting to the New Tax Era

A small logistics company struggled with compliance due to manual invoicing. After switching to ProInvoice:

- VAT tracking improved

- Invoice records became organized

- Audit preparation became easier

- Cash flow stabilized

This shift positioned the business for long-term growth.

Best Invoicing Practices Summary

To succeed in Nigeria’s new tax era:

- Use structured invoices

- Apply VAT correctly

- Maintain invoice history

- Automate tracking and reminders

- Go digital

- Use mobile invoicing

All these practices are built into ProInvoice.

Final Thoughts

The new tax era in Nigeria demands better documentation, transparency, and professionalism. By adopting the right invoicing practices for Nigerian businesses, entrepreneurs can stay compliant, protect their revenue, and grow confidently.

With ProInvoice, invoicing becomes a strategic advantage rather than an administrative burden.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!