A business can have a great product or loyal customers, but small business cash flow issues can still cause serious problems. Many small businesses struggle with small business cash flow problems. Often, inefficient invoicing is a major cause. An invoicing process isn’t just about sending a bill. It’s a critical part of a company’s financial health. This article explores the link between poor invoicing and cash flow crises. It also provides solutions to help small businesses succeed. By making systematic changes, businesses can turn invoicing from a simple task into a powerful tool. They can accelerate revenue and ensure long-term financial stability.

The Small Business Cash Flow Crisis

By the Numbers

Statistics show the tough reality for small businesses. A U.S. Bank study found that 82% of small businesses fail due to poor cash flow management. A big reason for this is late payments. A Fundbox survey revealed that small businesses are collectively owed over $825 billion in unpaid invoices. The average payment delay is more than two weeks. In some industries, like construction, delays are even longer. This constant lack of timely income makes it hard for a business to pay its own bills. It affects everything from employee salaries to future investments.

What Causes Small Business Cash Flow Problems?

Cash flow problems don’t always mean a business is doing poorly. Many things can trigger them. Seasonal fluctuations can lead to high expenses followed by low income. Client payment delays are a constant issue. They can happen because of a client’s own financial problems or internal processes. Unexpected expenses, like a broken piece of equipment, can also drain funds. Even rapid growth can cause a problem. A sudden increase in orders requires more capital for inventory and labor before the money from those sales comes in. All these factors can quickly create a crisis.

Related: The USA’s Digital Roadmap for SMEs

How Invoicing Affects Small Business Cash Flow

Poor invoicing is often the weakest part of a business’s financial health. It creates cash flow gaps by delaying when a business can collect money. Every day an invoice is unpaid, the business is funding its client instead of itself. The real cost of payment delays is not just the late payment. It’s the lost opportunity. This money could have paid down a high-interest loan or funded a new marketing campaign. The compound effect of multiple late payments is devastating. When several clients are late, the small amounts add up to a big financial shortfall. This can force a business into debt or even cause it to close. The entire invoicing process directly affects a business’s ability to maintain healthy cash flow

How Poor Invoicing Creates Small Business Cash Flow Issues

Many businesses treat invoicing as an afterthought. This approach, however, has real consequences. Poor invoicing practices worsen small business cash flow problems.

Delayed Invoice Delivery

One of the most common mistakes is sending invoices late. Many businesses use slow, manual processes. They create and send invoices only at the end of the month. This delays the payment clock. For example, if a job finishes on July 1st, but the invoice goes out on July 31st, a Net 30 term means payment won’t arrive until August 30th. That’s a 30-day delay. In a business where multiple people need to approve an invoice, delays can also happen. Missing client information, like a purchase order number, can cause an invoice to be rejected. This creates even more delays.

Unclear Payment Terms

An invoice should be clear. Vague payment terms give clients a reason to delay. For instance, “Due upon receipt” can be confusing. Instead, a business should use specific terms like “Due 15 days from invoice date.” An invoice must also include clear payment instructions. These can be bank account details or a link to an online payment portal. Without them, the client has to contact the business for help, which causes a delay. Also, a business should clearly state its late fee policy on the invoice. This makes the policy easier to enforce.

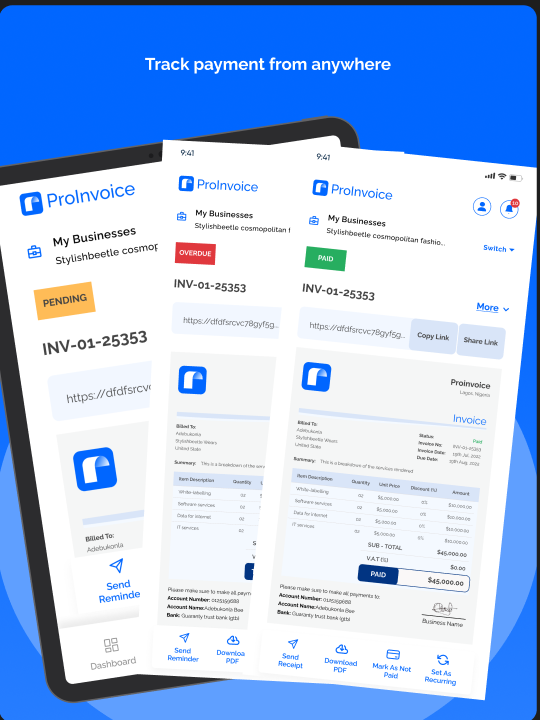

Proinvoice makes invoicing effortless. Use custom templates, automate reminders, set recurring bills, and track everything from one smart dashboard. Get paid faster — with less hassle.

Unprofessional Presentation

An invoice’s appearance can affect when it gets paid. A messy, unprofessional invoice can make a client see the business as less credible. This may cause the client to pay other, more professional-looking businesses first. A clean, well-designed invoice, with a business logo and no typos, projects competence. This professionalism can move the invoice higher up on a client’s payment list. This psychological factor is a powerful influence on cash flow.

Lack of Follow-Up Systems

Even with a perfect invoice, things can go wrong. Without a good follow-up system, an unpaid invoice can be forgotten. Many small businesses use manual tracking. This makes it hard for an owner to remember which invoices are due or late. This leads to inconsistent reminders. The owner may also avoid collection conversations to protect the client relationship. This harms cash flow and sets a bad precedent. Without an automated, professional follow-up system, invoices can remain unpaid indefinitely.

Strategic Invoicing Solutions for Small Business Cash Flow

To solve small business cash flow problems, a business needs a new strategy. We can break these solutions into three categories: immediate acceleration, systematic improvements, and professional follow-up.

A. Accelerating Payments to Improve Cash Flow

To fix cash flow problems fast, a business must shorten the time between invoicing and payment. These solutions help get money into the bank quickly.

Invoice Delivery Optimization

A business should send invoices as soon as a job is done. Same-day invoicing systems can create and send invoices automatically when a project is finished. This removes manual delays. Automated delivery scheduling ensures invoices for recurring services are sent on a set schedule. A business should also use a multiple delivery channel strategy. It should email a PDF and provide an online payment link, in addition to mailing a physical copy.

Payment Term Optimization

Payment terms have a big impact on cash flow. Instead of the standard Net 30, a business can try Net 15. This shorter window can double the speed of payments. A business can also offer early payment discount strategies. A 2% discount for payment within 10 days, for example, motivates clients to pay faster. For new or small jobs, a business can require payment due upon receipt.

Also Read: Tips for Negotiating Payment Terms and Rates with Clients.

Payment Method Diversification

Making it easier for clients to pay is key. A business should offer many payment options, especially digital ones. Online payment integration with services like Stripe allows clients to pay with a credit card or bank account from the invoice. This reduces friction. Mobile payment options like Apple Pay are also popular. For B2B clients, bank transfer automation provides all the needed details for a quick transfer.

B. Systematic Invoicing Improvements for Better Cash Flow

Beyond quick fixes, a business needs a better invoicing system to improve cash flow long-term.

Automated Invoicing Systems

Manual invoicing wastes time and causes errors. An automated system is the solution. It can create recurring invoices for monthly retainers. It can also use trigger-based invoice generation. This creates an invoice as soon as a project milestone is complete. Template standardization ensures every invoice is professional and error-free. This consistency builds client trust and reduces the chance of rejection.

Client Onboarding Optimization

The invoicing process begins when a new client signs on. By improving this process, a business can set itself up for success. This includes asking about a client’s payment preferences. For big projects, a credit application process can help assess a client’s risk. Most importantly, a business must set clear expectations. It should communicate its payment terms and policies before any work begins.

Progress Billing Implementation

For long projects, waiting until the end to bill is risky. Progress billing implementation breaks up the payment into smaller, manageable parts. This can be done with milestone-based payments, where an invoice is sent after each stage of a project. A business can also use a retainer collection strategy for ongoing services. A deposit requirement for new clients helps cover initial costs and provides a cushion. This spreads out financial risk and ensures steady income throughout a project.

C. Follow-Up Strategies to Protect Small Business Cash Flow

Even with a perfect system, some invoices will be late. A professional and automated collection process is vital for handling these situations without damaging client relationships. This is how to avoid invoice payment problems.

Automated Reminder Sequences

A business should not have to chase every late payment manually. An automated system can handle this. It can send pre-due date notifications a few days before an invoice is due. If payment is late, an escalating reminder schedule can send reminders on day 1, 7, and 14 after the due date. The tone can get firmer with each reminder. The system should also allow for a personal touch. For example, a business can make a phone call if the automated reminders don’t work.

Proinvoice makes invoicing effortless. Use custom templates, automate reminders, set recurring bills, and track everything from one smart dashboard. Get paid faster — with less hassle.

Professional Collection Processes

When an invoice is seriously overdue, a business needs a clear process. This starts with using polite but firm language templates in emails. These templates should state the amount, the due date, and the next steps. A business should define escalation procedures. This includes when to stop work or when to charge a late fee. For very late accounts, a business may need to consider third-party collection criteria. This outlines when to send the account to a collection agency. Having a clear policy shows the client the business is serious.

Client Relationship Management

Managing client relationships is part of the collection process. A good system should track payment history. This lets a business see which clients are consistently late. This data can be used for risk assessment. A business can then decide if a client should get credit terms or pay upfront. It’s also important to know a client’s communication preferences. By tailoring the follow-up process, a business can be more effective at getting paid without ruining the relationship.

Advanced Strategies for Small Business Cash Flow Management

Strategic invoicing is the foundation of healthy cash flow. However, some businesses need more advanced solutions. This is particularly true for businesses facing significant cash gaps or rapid growth. It goes beyond basic small business invoicing.

Invoice Factoring and Financing

When a business needs cash now, it can use invoice factoring and financing. Factoring involves selling invoices to a third party (a “factor”) for immediate cash at a discount. The factor then collects the payment from the client. Invoice financing is a loan against your outstanding invoices. A business should do a cost-benefit analysis before using these options, as fees can be high. It is also important to choose a reputable vendor. This tool is powerful but should be used strategically.

Subscription and Recurring Models

One of the best ways to get predictable cash flow is to move from one-time payments to a recurring model. Converting one-time to recurring services, like maintenance contracts, can greatly improve cash flow stability. Subscription pricing strategies provide a steady income stream each month. This also makes cash flow forecasting easier. It also improves client retention. Clients on a recurring plan are often more engaged with the business.

Cash Flow Forecasting

A business must be proactive with its cash flow. This means using cash flow forecasting. This is the process of predicting future financial positions. A key tool is the invoice aging report. It shows how long invoices have been outstanding. By analyzing payment trends, a business can see which clients are often late. It can use this data for seasonal planning. This helps a business prepare for times of low income and high expenses.

Implementation Roadmap

Changing a business’s invoicing process takes time. Here is a roadmap to guide the transition.

Week 1-2: Assessment and Setup

First, a business must audit its current process. It should identify bottlenecks, from invoice creation to collection. Then, it should choose and set up software that can automate these processes. Finally, it should create a professional and standardized invoice template.

Week 3-4: Client Communication

Once the new system is ready, clients must be informed. The business should send a notice about its new terms and payment methods. It’s crucial to set new expectations with clients who were used to a more lenient policy.

Month 2-3: Optimization

The initial setup is just the start. The next few months are for refining the process. The business should refine the process based on feedback. It should monitor performance using metrics like Days Sales Outstanding (DSO). Finally, it should commit to continuous improvement. It should regularly review its invoicing and collection processes.

Measuring Success

To know if the new strategies are working, a business must track key performance indicators (KPIs).

Key Performance Indicators

The most important KPI is Days Sales Outstanding (DSO). DSO is the average number of days it takes to collect a payment. A lower DSO means money is collected faster. This shows improved cash flow. The collection efficiency ratio is also key. It measures the percentage of receivables collected. A higher ratio means more efficient collection. The cash conversion cycle measures how long it takes to turn resources into cash. A shorter cycle means a healthier financial position.

Monitoring and Reporting

Tracking these KPIs requires regular reports. Monthly cash flow reports provide a clear picture of the business’s finances. These reports should include an invoice aging report to identify overdue invoices. A business should also analyze payment trends to monitor client behavior. This allows for early intervention with clients who are consistently late.

Proinvoice makes invoicing effortless. Use custom templates, automate reminders, set recurring bills, and track everything from one smart dashboard. Get paid faster — with less hassle.

Conclusion

The connection between invoicing and cash flow is direct. By moving from a manual approach to a strategic one, small businesses can take control of their finances. The solutions discussed here are not just about getting paid faster. They are about building a strong business. Within a few months, a business can see a significant drop in its DSO and a healthier cash conversion cycle. The long-term benefits include predictable income, less stress, and the freedom to grow. Business owners should commit to this change. They should use the available resources and make invoicing a core business function.