In business, who issues a sales invoice? Sales invoices are a key part of a company’s finances; a seamless way to track services provided to clients, how much they owe, and when they are expected to remit payment.

A sales invoice is issued by a seller or service provider. This is done as proof that a product or service has been offered and payment is being requested from the buyer.

The sales invoice will serve as evidence of the transaction whether in cash or on credit. At the end of every sales process, businesses generate invoices to require payment from customers.

While most businesses do this immediately after a service has been rendered, others send a copy of the invoice to clients at a later date.

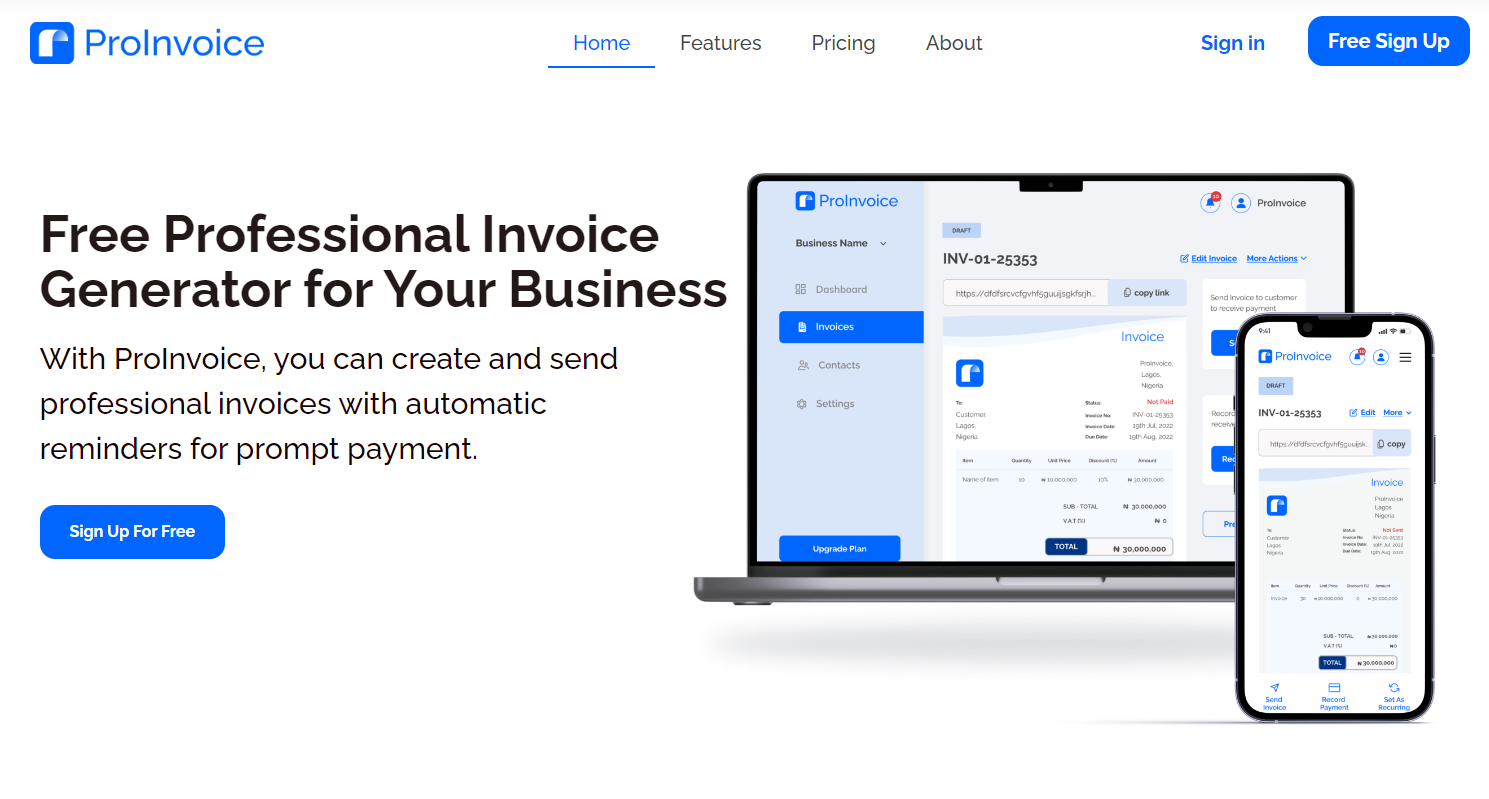

When issuing someone an invoice via email or an invoicing software like ProInvoice, ensure you list out information like list of items or goods sold, payment due, and dates too.

The company in question receives a notification once they receive the document. In this article, we further discuss everything presenting an invoice entails.

Article Content:

- What is a sales invoice?

- Who issues a sales invoice?

- How to raise a sales invoice?

- Importance of sales invoice?

- Elements of a sales invoice

What Is A Sales Invoice?

A sales invoice is a simple accounting document sent in respect of goods or services purchased by a buyer.

It covers information like services, items sold, amount owed by the client, and how they are expected to pay.

An invoice creates agreements that are legally binding between buyers and sellers, especially for larger transactions.

Who Issues A Sales Invoice?

A sales invoice is issued by a seller or service provider. They are the ones with information about the transaction and are in a better position to issue one.

The document confirms a purchase and requests for payment for it. Invoices are important because it notes the transaction details between you and a buyer.

It gives your client a record of what was purchased and when. For you it tracks what was sold and for how much.

How To Raise A Sales Invoice?

When raising a sales invoice, there are several rules you are expected to follow.

Now, the information you enter are entirely yours, but these guidelines we suggest further legitimize your document.

1. Keep It Concise

Information entered into your invoice should be short and easy to absorb. Don’t overpower it with ambiguous statements.

2. Double Check The Grammar And Spellings

Your sales invoice should be error-free and ensure you proofread it before sending it to the customer.

3. Send It Early

Be prompt when sending out sales invoices. Don’t wait for a week later, send it the second the transaction is complete.

4. Be Organized

Organize the invoice in a file. Keep a copy for yourself for proof or easy bookkeeping.

Importance Of Sales Invoice?

A seller can issue a sales invoice for many reasons, we listed some of them below:

1. Tax Returns

Sales invoices are important for taxes because they contain records of your income and expenses.

2. Bookkeeping

If you don’t know where to begin with bookkeeping, keeping copies of your sales invoice is a great place to begin.

Once it has been raised, it can be tracked as accounts receivable by an accountant or bookkeeper. This can be useful for expected revenue and tracking overdue payments.

3. Inventory Management

Sales invoices give a clear picture of which of your inventory items are selling and which ones are not.

You can further use this decision to reorder or stop selling some products because they are not bringing in profits. You could also adjust your inventory to meet demands.

4. Legal Protection

In case of a disagreement or even misunderstanding, sales invoices can support your claims that you sold a particular good or service to a client.

It can also serve as proof of payment, which makes them great for resolving such matters.

5. Data For Business Strategy

Sales information gives you an idea of which each customer prefers, the amount they can pay for it, and how often they buy certain items.

You can use this data to determine pricing, marketing, and product development.

Similarly, if you’re a business that sells goods in different sizes and colors, you can use them to track individual items sales and preferences.

Elements Of A Sales Invoice

Sales Invoices contain a lot of data enclosed in a small document. You have one page or less to pass all that information across.

It might seem like an uphill task, but with simple formatting you can include the important items into your invoice.

1. Contact Data

The seller’s contact information (Yours) and the buyers information should appear directly after the header in a sales invoice.

This data includes – phone numbers, email addresses, and physical information.

2. Invoice Number and Date

A unique identification number should be attached to a sales invoice for tracking purposes. Add the issue date and expected payment date too.

3. Details Of Goods And Services Offered

These details should be added to the body of the invoice. Every item should be on its own line with a brief description, unit price, and quantity.

4. Due Amount

The due amount is the total sum of money the customer should pay to you. Add item costs, taxes where applicable, discounts, and any outstanding payments too.

5. Set Payment Terms

Setting payment terms lets clients know when they are expected to pay and how. Any preferred payment methods and account numbers should be added to the sales invoice as well.

Don’t forget to add the time frame for when you expect the payment to be made.

Sales invoices are a crucial part of maintaining a prosperous business, especially if you want to be able to account for every expense made and profits you receive too.

Ensure you track every invoice issued and the payment status for all of them. This can help you understand your business sales performance and cash flow.

Additionally, you’ll be able to make more insight-driven decisions and plan ahead.