Discover 11 Best AI Accounting Software and Tools – U.S.A. Edition [2025]: AI accounting software revolutionizes financial management processes. It automates complex data entry and generates real-time reports. The technology accelerates month-end reconciliations and detects fraudulent activities. However, the AI revolution is still in early stages. Choosing the right AI accounting software for your organization remains challenging.

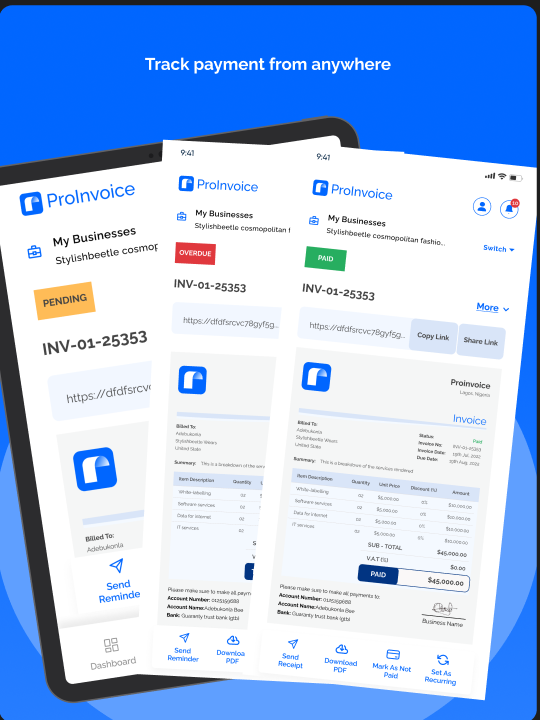

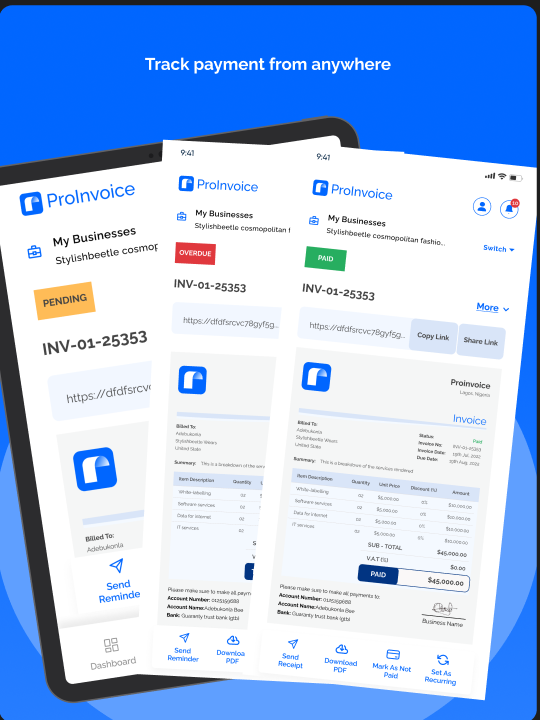

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

This guide explores how artificial intelligence transforms accounting processes. We analyze leading AI accounting solutions available today. This helps you make informed decisions for your business needs.

Key Takeaways

AI accounting software automates traditional processes effectively. It handles data entry, financial reporting, reconciliations, and tax compliance. Machine learning and predictive analytics power these capabilities. Current AI accounting solutions vary significantly in functionality. They target different user segments from small businesses to enterprises.

The most effective AI accounting tools reduce manual workload substantially. They enhance data accuracy and provide real-time financial insights. These tools scale seamlessly as businesses expand. Focus on integration capabilities when evaluating solutions. Consider automation features and operational alignment requirements.

What Is AI Accounting Software?

AI accounting software leverages artificial intelligence technologies for automation. It automates accounting processes that traditionally required manual intervention. These systems differ from standard automation tools significantly. They use machine learning algorithms and predictive analytics effectively. The software processes complex financial data automatically.

These intelligent systems handle comprehensive financial tasks. Automated data entry, account reconciliations, and budget forecasting are core functions. Expense categorization and advanced fraud detection are additional capabilities. AI accounting software eliminates repetitive manual tasks completely. Accounting teams can focus on strategic analysis and financial planning.

Proinvoice makes invoicing effortless. Use custom templates, automate reminders, set recurring bills, and track everything from one smart dashboard. Get paid faster — with less hassle.

Common Use Cases for AI Accounting Software

Modern AI accounting solutions address multiple operational challenges effectively. These challenges historically consumed significant time and resources. Data consolidation, processing, and comprehensive reporting benefit greatly. Tax preparation becomes more efficient with AI assistance. These tools save valuable time and improve accuracy levels.

Data Entry and Processing: AI systems capture financial data automatically. They categorize and input data from invoices, receipts, and bank statements. This eliminates hours of manual work each week. Human error rates reduce significantly through automation.

Month-End Close Acceleration: Advanced AI tools match transactions automatically. They identify discrepancies quickly and generate comprehensive reports. Month-end closing processes accelerate dramatically. Overall accuracy and compliance improve simultaneously.

Financial Reporting and Analysis: AI platforms analyze vast financial data amounts. Real-time analysis creates accurate, detailed reports faster. Traditional methods cannot match this speed. Calculation errors and data inconsistencies decrease substantially.

Fraud Detection and Security: Machine learning algorithms detect suspicious patterns effectively. They analyze historical data trends for unusual transactions. Potential fraud attempts receive immediate flagging. Financial discrepancies are identified before becoming significant problems.

Budgeting and Forecasting: AI systems process historical financial data comprehensively. Market trends inform predictive models and accurate forecasts. Financial planning becomes more reliable through AI assistance. Strategic decision-making processes improve with better data.

11 Best AI Accounting Software Solutions

1. NetSuite AI Features

NetSuite’s AI-powered accounting provides comprehensive ERP integration. Intelligent automation features streamline complex financial processes. The platform combines traditional accounting with machine learning algorithms. Growing businesses benefit from scalable solutions design.

Key features include automated transaction matching capabilities. Intelligent expense categorization processes transactions efficiently. Predictive cash flow analysis provides future insights. Advanced reporting capabilities support strategic decisions. NetSuite’s AI learns from historical data patterns continuously. Accuracy improves over time with machine learning. Real-time financial insights support business functions across organizations.

2. QuickBooks Advanced AI

QuickBooks integrates artificial intelligence throughout its platform comprehensively. Bookkeeping tasks receive automated processing efficiently. Transaction categorization happens intelligently through AI algorithms. Small and medium-sized businesses benefit most from these features. AI learns from user behavior and transaction patterns.

The platform offers automated invoice processing capabilities. Expense tracking functions automatically with high accuracy. Tax preparation assistance reduces manual effort significantly. Cash flow forecasting provides valuable business insights. QuickBooks AI helps businesses maintain accurate financial records. Actionable insights support growth planning and operational efficiency.

3. Xero AI-Powered Features

Xero incorporates machine learning capabilities for automation efficiency. Bank reconciliation processes automatically with high accuracy. Transaction categorization happens intelligently through AI algorithms. Businesses of all sizes benefit from comprehensive reporting. AI algorithms analyze spending patterns and financial trends effectively.

Advanced features include automated invoice matching capabilities. Smart expense categorization reduces manual processing time. Predictive cash flow modeling provides future financial insights. Intelligent financial reporting supports strategic decision-making processes. Xero’s AI learns from user interactions continuously. Automation accuracy improves while maintaining comprehensive audit trails. As businesses handle complex financial operations, efficient invoicing becomes crucial. Streamlined invoice management helps maintain professional client relationships.

4. Sage Intacct AI Solutions

Sage Intacct delivers AI-driven financial management for enterprises. The platform targets mid-market and enterprise organizations specifically. Sophisticated accounting automation handles complex requirements efficiently. Machine learning automates financial processes and provides predictive analytics. Comprehensive reporting covers multiple entities and locations.

Core AI features include automated journal entry processing. Intelligent expense management reduces manual oversight requirements. Advanced financial reporting provides detailed insights. Predictive budget analysis supports strategic planning initiatives. Sage Intacct’s AI capabilities streamline month-end close processes. Financial accuracy improves across all business segments. Real-time visibility enhances financial performance monitoring.

5. Vic.ai Accounts Payable Automation

Vic.ai specializes in accounts payable automation exclusively. Advanced artificial intelligence and machine learning power the platform. Manual invoice processing becomes completely eliminated. Automated capture, processing, and approval streamline workflows. ERP and accounting system integration happens seamlessly.

The solution offers intelligent invoice capture capabilities. Automated purchase order matching reduces processing time significantly. Smart approval workflows eliminate manual bottlenecks efficiently. Comprehensive audit trails maintain compliance requirements. Vic.ai’s machine learning algorithms improve accuracy continuously. Processing time and operational costs decrease substantially. For businesses managing multiple vendor relationships, professional invoicing systems become essential for organized operations.

6. DataSnipper Audit Automation

DataSnipper transforms audit and financial review processes completely. Intelligent automation reduces manual testing and documentation requirements. The platform automates routine audit procedures efficiently. Relevant information extraction from financial documents happens automatically. Comprehensive audit documentation generates without manual intervention.

Key capabilities include automated account reconciliation processes. Intelligent risk assessment identifies potential issues early. Document analysis automation accelerates review procedures. Comprehensive audit trail generation maintains compliance standards. DataSnipper’s AI-powered features help audit teams focus strategically. Thorough documentation and compliance requirements receive automated support.

7. MindBridge AI Fraud Detection

MindBridge AI provides advanced fraud detection capabilities. Financial risk analysis uses sophisticated machine learning algorithms. Transaction patterns receive comprehensive analysis automatically. Anomaly identification happens before problems become significant. Organizations detect potential fraud, errors, and irregularities proactively.

The solution offers comprehensive transaction analysis capabilities. Risk scoring algorithms evaluate potential threats automatically. Automated anomaly detection identifies suspicious activities immediately. Detailed investigation tools support thorough analysis processes. MindBridge AI’s machine learning improves detection accuracy continuously. Clear insights into potential financial risks support proactive management.

8. Botkeeper Automated Bookkeeping

Botkeeper combines artificial intelligence with human oversight effectively. Comprehensive automated bookkeeping serves small and medium businesses. Machine learning categorizes transactions and reconciles accounts automatically. Financial reports generate with expert review processes. Accuracy maintains high standards through dual oversight.

Features include automated bank reconciliation capabilities. Intelligent transaction categorization processes financial data efficiently. Comprehensive financial reporting provides detailed business insights. Dedicated client support ensures smooth operations continuously. Botkeeper’s AI learns from business-specific patterns effectively. Automation accuracy improves while reliable financial management scales.

9. Docyt AI Accounting Assistant

Docyt features Gary, an AI-powered accounting assistant. Expense management, receipt processing, and financial reporting receive automation. Various industries benefit from comprehensive business solutions. Chatbot functionality combines with process automation effectively. Accounting workflows become streamlined through intelligent assistance.

The solution provides automated expense categorization capabilities. Intelligent receipt processing eliminates manual data entry. Real-time financial reporting keeps businesses informed continuously. Industry-specific accounting templates reduce setup time significantly. Docyt’s AI learns from historical transaction data. Categorization accuracy improves while automated compliance support continues.

10. Zeni AI-Powered Bookkeeping

Zeni offers comprehensive AI-driven bookkeeping for startups specifically. Growing technology companies receive targeted financial solutions. Automated transaction processing combines with expert human oversight. Accurate financial management supports rapidly scaling businesses. Strategic insights help guide growth initiatives.

Core features include automated bookkeeping processes. Intelligent financial reporting provides detailed business insights. Cash flow forecasting helps predict future financial needs. Investor-ready financial statements support funding activities. Zeni’s AI algorithms analyze transaction patterns and spending trends. Actionable insights support strategic planning while maintaining accurate records.

Proinvoice makes invoicing effortless. Use custom templates, automate reminders, set recurring bills, and track everything from one smart dashboard. Get paid faster — with less hassle.

11. TaxDome Practice Management

TaxDome integrates AI capabilities throughout its practice management platform. Client communication, document processing, and workflow management receive automation. Accounting and tax professionals benefit from comprehensive solutions. Machine learning streamlines administrative tasks effectively. Client service delivery improves through intelligent assistance.

Key AI features include automated document organization capabilities. Intelligent client communication reduces manual correspondence requirements. Workflow automation eliminates repetitive administrative tasks efficiently. Comprehensive practice analytics provide business performance insights. TaxDome’s AI helps accounting firms reduce administrative overhead. Client satisfaction and operational efficiency improve simultaneously. When handling multiple client projects, efficient invoice generation becomes crucial for professional standards.

What Is AI’s Role in Modern Accounting?

Artificial intelligence serves as a transformative force in accounting. It enhances various processes and enables strategic work. AI’s primary role involves reducing repetitive number-crunching activities. Accounting teams spend more time on strategic analysis. Financial planning and business advisory services add significant value.

AI tools excel at analyzing vast financial data amounts. Quick and accurate processing supports multiple functions simultaneously. Data processing, anomaly detection, and predictive analysis benefit greatly. Pattern identification becomes possible beyond manual review capabilities. Accounting professionals focus on higher-level strategic activities. Accuracy and compliance standards maintain high levels. As AI handles routine tasks, businesses need reliable client-facing systems. Professional invoicing solutions help maintain consistent client relationships.

Key Benefits of AI Accounting Software

Enhanced Accuracy and Reduced Errors: AI systems eliminate human errors completely. Manual data entry and calculation mistakes disappear. Consistently accurate financial records result from automation. Costly mistakes that impact business operations reduce significantly. Compliance requirements receive better support through accuracy.

Significant Time Savings: Automated processing accelerates routine tasks substantially. Month-end closes complete faster with AI assistance. Invoice processing becomes more efficient through automation. Report generation happens in real-time rather than hours. Manual compilation and verification activities decrease dramatically.

Real-Time Financial Insights: AI-powered analytics provide immediate visibility effectively. Financial performance, cash flow trends, and potential issues receive instant monitoring. Proactive decision-making becomes possible with current data. Strategic planning improves beyond historical report limitations.

Scalable Solutions: AI accounting software grows with businesses seamlessly. Increased transaction volumes receive automatic handling. Additional entities and complex reporting requirements scale automatically. Proportional staffing increases become unnecessary through automation.

Improved Compliance: Automated compliance monitoring ensures adherence continuously. Accounting standards, tax regulations, and industry requirements receive automatic support. Comprehensive audit trails maintain documentation for regulatory reviews.

How to Choose the Right AI Accounting Software

Assess Integration Capabilities: AI accounting solutions must integrate seamlessly. Existing business systems, ERP platforms, and banking systems require connectivity. Financial tools need data consistency maintenance. Workflow efficiency across operations depends on proper integration.

Evaluate Automation Features: Comprehensive automation capabilities should address specific pain points. Invoice processing, expense categorization, and reconciliation processes need evaluation. Financial reporting requirements consume significant manual effort currently. Choose solutions that automate your biggest challenges.

Consider Scalability Requirements: Solutions must grow with business expansion. Increased transaction volumes need accommodation without system replacements. Additional users and complex reporting requirements should scale automatically. Operational growth must receive seamless support.

Review Security and Compliance: AI accounting software must meet industry security standards. Robust data protection measures are non-negotiable requirements. Relevant regulations and accounting standards need support. Industry-specific compliance requirements vary significantly.

Analyze Total Cost of Ownership: Subscription costs represent only partial expenses. Implementation costs, training requirements, and integration expenses matter. Potential productivity gains offset initial investments over time. For businesses requiring streamlined client billing, integrated invoicing tools provide essential functionality.

Future of AI in Accounting

The accounting profession continues evolving with AI advancement. Artificial intelligence capabilities become more sophisticated continuously. Future developments will include advanced predictive analytics. Natural language processing will handle complex financial analysis. Integration between business systems and platforms will improve.

Emerging AI technologies enable sophisticated fraud detection. Automated compliance monitoring becomes more comprehensive. Intelligent financial advisory capabilities help businesses make better decisions. Accounting professionals will focus increasingly on strategic advisory roles. AI will handle routine operational tasks completely. During this transition, maintaining professional invoice management ensures strong client relationships.

Conclusion

AI accounting software represents significant opportunities for businesses. Efficiency, accuracy, and strategic decision-making capabilities improve substantially. The solutions in this guide offer various automation approaches. Comprehensive enterprise platforms serve different needs than specialized tools. Each solution addresses specific accounting challenges effectively.

Success with AI accounting software depends on careful evaluation. Specific needs assessment guides proper solution selection. Implementation planning ensures smooth transitions to new systems. Business goals and growth trajectory alignment matters significantly. Artificial intelligence advancement continues accelerating rapidly. Early adopters gain competitive advantages through improved efficiency. Enhanced financial insights support better business outcomes.

Ready to streamline operations with AI accounting software? While implementing advanced accounting automation, professional client communication remains crucial. Efficient invoicing solutions ensure client relationships stay polished during digital transformation.