If you own a small business, we hope that you will the invoicing tips valuable to help you streamline your business finances.

An invoice is one of the important parts of a business, as it plays a significant role in the cash flow of your company, shows a positive image of your company, and also an invoice shows the professionalism of your business entity.

As a small business owner, it is important to streamline your finances through your invoice.

To ensure the efficiency of the invoice as a small business owner, it will be important if you will make some tips and adapt these tips as a routine while preparing your invoice to make your finances more effective.

Many Invoicing tips will make you streamline your finances as a small business owner.

Some of these Invoicing tips include: making the mode of payment easier, taking advantage of invoicing automation software, follow-up invoice for overdue payments, always maintaining invoice records, and application of overdue fines.

These are a few invoicing tips that will ensure the efficiency of finance in your small business.

A Look At The Top Invoicing Tips For Small Business Owners

1. Making Mode of Payment Easier

A small business needs to have diverse methods of payment, to ensure ease of payment for the customer.

Customer satisfaction with payment methods will give your business an edge over competitors, increase your cash flow and that of the customer, decrease overhead costs, attract new customers, and retain old customers.

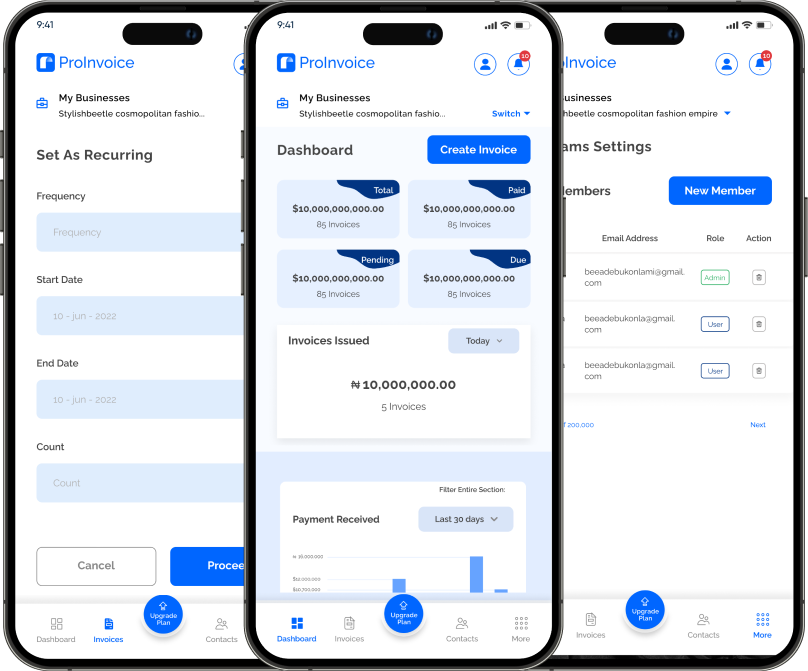

2. Taking Advantage of Invoicing Automation Software

Manual Invoicing is obsolete, and only outdated business entities use it. As a small business owner, it is important to use invoicing automation software, which is free from all forms of error and shows the professionalism of your business.

The process of using invoice automation software helps your business in many ways.

Some of these ways are: tracking accounting and bookkeeping records, avoiding the entanglement of recurring tasks like generating an invoice, sending admonition, improving ROI and savings, and many more.

a. Track Accounting and Bookkeeping Records

As a financial document that contains detailed information and transactions of a customer and a business entity, an invoice helps to keep accounting and bookkeeping track records, and any form of financial statements, an invoice shows you your revenues and expenses.

b. Generating Invoice Template

Automated invoice software helps you to generate invoices and invoice templates that will help create an error-free invoice. Some of the errors that automated invoice software helps you get rid of are:

- Spelling and typos

- Calculation mistakes

- Company missing Information

These are a few errors that can be reduced by using automation software to generate an invoice template.

c. Sending Admonition

Using automated invoice software helps you to send reminders to your customers.

This process helps reduce late payment, as the invoice software sends automatic notifications to your customers through email, text, and any other form of social media integration to the invoice software. This process increases cash flow.

d. Improve ROI and Savings

Using Invoicing generating software helps you see your return on investment in a short period, and helps you save time and money.

Using an invoice generator is the modern way of Invoicing, saves time and money, and shows the professionalism of your company. This invoicing tip can help increase your savings by a good percentage.

3. Follow-up Invoice for Late Payment

Following up on an invoice for an overdue or failed payment is important. Because if your customer doesn’t pay their debt your company will not be able to function well, as cash flow will be limited.

To streamline the finance of your business, it will be important if you send a follow-up email that is not done randomly as there are many templates of follow-up emails for late payment, here two of the templates will be highlighted.

The first template is the reminder email template before late payment while the second template is the late payment reminder template.

Reminder Email Template Before Late Payment

This template reminds the client before the payment date to prepare ahead of the payment date to avoid late payment.

It is a good mindset to email the client if they have seen the invoice to avoid late payment.

Type of Email:

Reminder email template before late payment

The subject of the email:

[Business name and Invoice Number]

Body of email:

Hello [Beneficiary’s name],

Hope is doing fine.

I am reaching out to you as a representative of [Your business name] pertaining to the following Invoice: [Invoice reference number]

Please take your time to review this invoice.

As this message serves as a friendly reminder.

If you have any questions you can reach out to me concerning this invoice. Regards.

[Sender’s name]

Late Payment Reminder Template

This template gives you the insight that you need when the client does not respond to the invoice until it is overdue, as the template will be drafted below.

Type of Email:

Late payment reminder email

The subject of the email:

[Business name and Invoice Number]

Body of mail:

Hello [Beneficiary’s name]

Hope you are doing fine.

I want to reach out to you about the invoice [invoice reference number] which was due on [Due date of invoice].

Payment is expected from you since [Due date] as we are still counting on you.

Please if you find any difficulty that results in overdue of this invoice do not hesitate to contact me.

Regards.

[Sender’s name]

These above templates of follow-up emails will help your business grow and avoid payment delays.

4. Maintaining Invoice Records

Invoice is pivotal to small businesses as well as large businesses, it is important to record any invoice and to have a backup storage In case any accident may occur that will lead to the loss of financial documents.

It is advisable to have cloud storage that will serve as backup In case anything goes wrong.

Another way of maintaining invoice records is to use invoice-generating software that will help you distinguish between many repetitive tasks.

5. Application of Overdue Fine

Otherwise known as late payment fees which encourage clients to clear their bills on time. Without any shadow of a doubt, the application of overdue fines has helped many businesses to boost their cash flow.

Without the application of overdue fines, many customers will end up neglecting the invoice sent to them.

Final Thoughts

For a small business to thrive and to streamline its finances, it is important to ensure some of these invoicing tips are adhered to in processing its invoice, as well as to adapt to these procedures to become routine, because invoice shows professionalism and a positive image of your business.