Every small business owner in Kenya and Ghana understands the frustration that comes with late payments. Although your business may offer exceptional service, clients often delay payment for reasons ranging from forgotten invoices to unclear terms or slow manual billing processes. Because of this, cash flow becomes unpredictable, making it harder for SMEs to grow confidently.

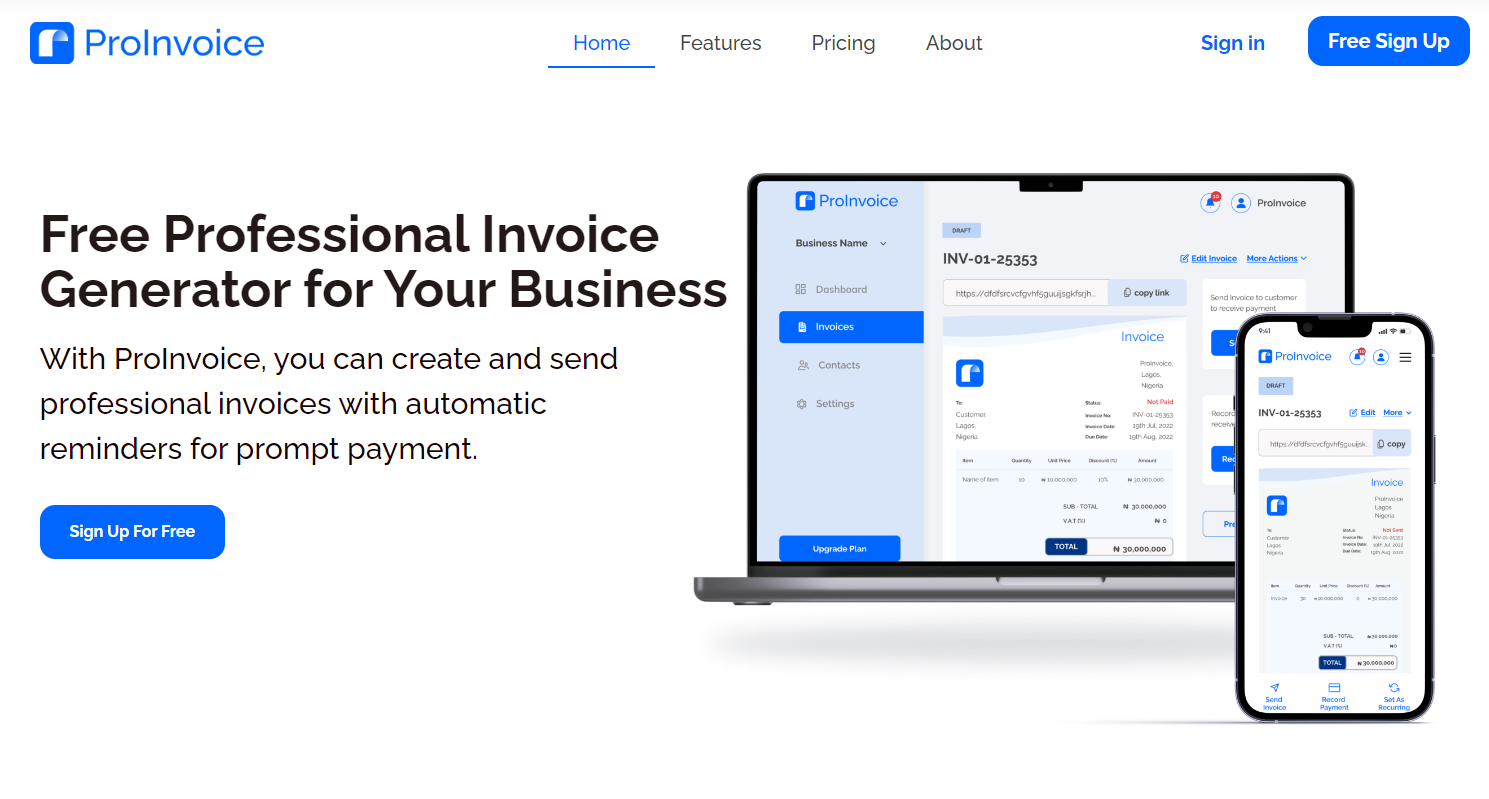

Fortunately, modern tools now make payments faster, simpler, and more reliable. When you use smart invoice tools, you speed up the billing cycle, eliminate delays, reduce manual follow-ups, and make your business easier for clients to pay. In fact, automated invoicing systems like ProInvoice help streamline the entire process—from creating the invoice to tracking payment status.

In this guide, you will learn practical, proven strategies that help you get clients to pay faster, using the power of smart invoicing features available on ProInvoice.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

1. Create Clear and Professional Invoices

Clients pay faster when they understand your invoice instantly. Whenever details are unclear, the approval team pauses the process and requests clarification. Because of this, the payment cycle becomes longer than necessary.

Smart invoice tools prevent this delay. They provide you with clean, structured, and professional templates that ensure accuracy and clarity. Additionally, calculations such as VAT, totals, and discounts are handled automatically. This reduces errors and improves trust.

If you want to create a clean and quick invoice now, try the ProInvoice Free Invoice Generator:

👉 https://proinvoice.co/free-invoice-generator-ng

2. Define Specific Payment Terms Upfront

Most clients delay payment simply because the invoice did not communicate deadlines properly. Therefore, your payment terms must be visible, precise, and easy to interpret. Smart invoicing tools make this effortless.

With ProInvoice, you can:

- Set clear due dates

- Add payment instructions

- Display VAT breakdowns

- Insert penalties or early-payment incentives

- Make your terms reusable

As a result, clients understand expectations from the start, reducing delays dramatically.

3. Offer Easy and Fast Ways to Pay

When paying you becomes convenient, clients settle their invoices more quickly. Instead of sending scattered instructions or multiple emails, smart tools include payment details directly on the invoice.

Using ProInvoice, you can:

- Add your preferred local payment instructions

- Allow clients to pay digitally

- Accept international payments via Stripe on the ProInvoice mobile app

- Reduce friction by making payments accessible

Because clients have everything they need in one place, they pay without unnecessary back-and-forth.

Register to start receiving digital payments:

👉 https://app.proinvoice.co/auth/register?code=SEO

4. Use Automated Payment Reminders

Clients easily forget invoices, especially when they handle multiple vendors. This is why reminders are essential. However, sending reminders manually takes time and may feel uncomfortable for many business owners.

Smart invoice tools solve this perfectly. They send automated reminders before the due date, on the due date, and after the invoice becomes overdue. This helps your business stay top-of-mind without sounding confrontational.

As reminders go out automatically, your cash flow improves consistently.

5. Track Invoice Status in Real Time

Uncertainty causes delays. Whenever you don’t know whether a client opened or acknowledged your invoice, the follow-up process becomes difficult. Thankfully, smart invoice tools eliminate this guesswork.

ProInvoice gives you real-time visibility by allowing you to:

- See when an invoice is opened

- Track payment progress

- View pending, overdue, and completed invoices

- Understand client payment behavior

- Know when to follow up

With this information, you make faster decisions and maintain control over your billing cycle.

6. Use Smart Templates for Consistency

Invoice inconsistencies slow approval. Many organizations in Kenya and Ghana won’t process an invoice until it follows a recognizable structure. When each invoice looks different, clients take longer to verify your details.

Smart invoice templates fix this instantly. ProInvoice ensures every invoice maintains the same format, branding, and layout. Moreover, the system highlights missing fields so nothing important is forgotten.

Consistency leads to faster approvals and fewer disputes.

7. Add Digital Signatures and Stamps

Some businesses require signatures or authorization stamps before processing payments. Rather than scanning documents manually, smart invoice tools let you insert digital signatures directly on the invoice.

With ProInvoice, you can add:

- Digital signatures

- Business stamps

- Custom authorization details

- Verified company information

This reduces delays caused by missing signatures or incomplete approval documents.

8. Keep Records Organized and Accessible

Invoices often get delayed because clients misplace previous files or request older documents before processing new ones. When your business keeps poor records, this problem becomes even worse.

Smart tools help you avoid this. ProInvoice stores all invoices, receipts, and client histories in one secure location. Additionally, you can download documents instantly whenever a client requests clarification.

Because everything is organized, disputes reduce significantly—and payments move faster.

9. Send Invoices Immediately After Work Is Done

The earlier clients receive your invoice, the sooner the payment cycle begins. Yet many SMEs delay because they wait until they return to the office or find time to prepare the document.

Smart invoicing tools remove that barrier. You can create and send invoices instantly from your phone using the ProInvoice Mobile App.

Download here:

👉 https://proinvoice.co/mobile-app/

Instant invoicing means your business loses zero time.

10. Improve Trust With a More Professional Presentation

Trust influences payment speed more than business owners realize. When clients view your business as organized, modern, and structured, they feel more confident processing your payments on time.

Smart invoicing tools strengthen your professional image. They ensure your invoices look polished, your reminders follow a schedule, and your records stay accurate. Moreover, automation shows clients that your business operates efficiently.

When trust increases, payment delays naturally reduce.

11. Avoid Lost or Forgotten Invoices

Traditional invoices—especially PDFs sent manually—can get buried in email inboxes or accidentally deleted. As a result, payments get pushed back repeatedly.

Smart invoicing platforms avoid this problem by using structured invoice links. Clients receive a clean, easy-to-open invoice page instead of an attachment. Furthermore, automated reminders ensure the invoice never disappears from their attention.

With better visibility, payment comes faster.

12. Use Analytics to Improve How You Manage Clients

Understanding payment trends allows you to manage relationships wisely. For example, identifying clients who always delay payments helps you adjust your terms or request deposits upfront.

ProInvoice analytics lets you review:

- Average payment times

- Top-paying clients

- Late payers

- Unpaid invoices

- Monthly revenue patterns

As a result, your decisions become data-driven, helping you manage your cash flow proactively.

Conclusion

Getting clients to pay faster is not about pressure; it is about efficiency, clarity, and smart systems. With automated tools like ProInvoice, your business reduces manual work, improves follow-up accuracy, boosts professionalism, and shortens the entire payment cycle.

By integrating smart invoicing tools, businesses in Ghana and Kenya can:

- Send invoices faster

- Track payments clearly

- Automate reminders

- Avoid disputes

- Strengthen client trust

- Keep accurate records

- Accept digital payments

Faster payments mean stronger cash flow—and stronger cash flow means growth.

Getting clients to pay on time is one of the biggest challenges small businesses face. Late payments slow down cash flow, make planning difficult, and can even affect your ability to operate smoothly. Fortunately, smart invoice tools can drastically reduce payment delays and help you get paid faster. By using automation, reminders, and clear payment options, you create a system that encourages clients to settle invoices quickly.

1. Use Automated Invoicing for Instant Delivery

When invoices are sent late, payments will also come in late. Smart invoicing tools allow you to automate the entire process so invoices go out immediately after work is completed. As a result, clients receive their bills faster, and your payment cycle shortens naturally. In addition, automation eliminates human error, making the process more reliable.

2. Add Multiple Payment Options

Clients pay faster when the process is convenient. Therefore, offer several payment methods such as card payments, bank transfers, or digital wallets. When customers have choices, they’re less likely to postpone payment. Moreover, integrated payment links in your invoices make settling bills a simple one-click action.

3. Use Automated Payment Reminders

Many clients don’t delay payment intentionally—they just forget. Automated reminders solve this by nudging clients before, on, and after the due date. These timely notifications help maintain professionalism while ensuring clients stay aware of their obligations. Ultimately, reminders keep invoices from being overlooked.

4. Add Clear Terms and Deadlines

Unclear expectations lead to late payments. To avoid this, specify your due dates, penalties, discounts, and terms clearly on every invoice. This level of clarity helps clients plan ahead and eliminates misunderstandings. As a result, you maintain transparency while encouraging faster payments.

5. Offer Early Payment Incentives

In some cases, incentives motivate clients to act faster. Offering small discounts for early payments can significantly reduce delays. Additionally, incentives help you build stronger relationships with clients, showing that you appreciate prompt action.

6. Track Invoice Status in Real Time

Smart invoice tools often include tracking features that show whether a client has viewed or opened an invoice. Consequently, you can follow up at the right time with accurate information. Furthermore, this visibility helps you understand client behavior and plan your communication more effectively.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

Start Getting Paid Faster Today

Here are the most important ProInvoice tools to help your business:

👉 Create invoices instantly:

https://proinvoice.co/free-invoice-generator-ng

👉 Register your business on ProInvoice:

https://app.proinvoice.co/auth/register?code=SEO

👉 Use the mobile app for quick invoicing:

https://proinvoice.co/mobile-app/