If you’re looking to grow your money in Nigeria, you’ve likely asked, “Which investment apps are actually safe and legit or Top 15 Legit Investment Apps in Nigeria (2025 Update)?

With online scams rising and Ponzi schemes rebranding themselves, Nigerians have become smarter and more cautious. Thankfully, there are credible and regulated investment platforms helping millions build wealth through stocks, savings, mutual funds, and more.

In this article, you’ll discover 15 of the top legit investment apps in Nigeria—what they offer, who they’re ideal for, and why they’re trusted.

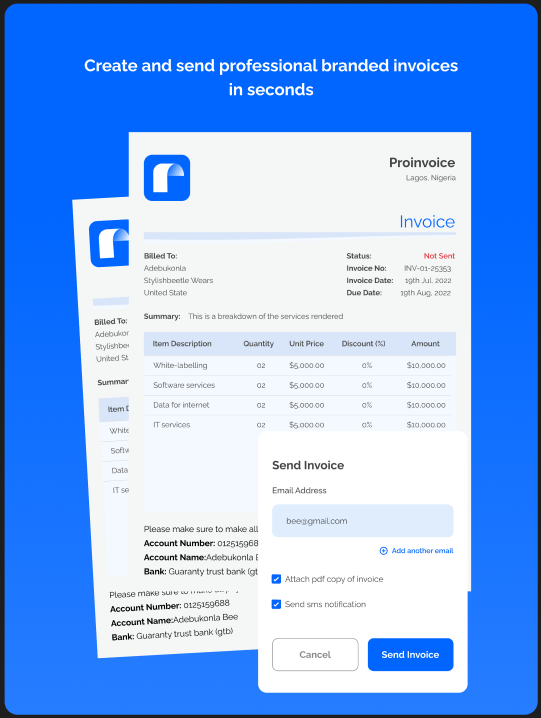

And as you grow your income and start earning passively, remember to keep your finances organized. If you run a side hustle, use ProInvoice to send invoices, track payments, and present your business professionally.

Let’s explore the list.

1. Cowrywise

Cowrywise allows you to automate your savings and invest in mutual funds with as little as ₦100. It’s licensed by the SEC (Securities and Exchange Commission).

✅ Auto-save feature

✅ Competitive interest rates

✅ Diverse mutual funds

2. PiggyVest

Probably the most popular savings and investment platform in Nigeria. It started with just savings but now allows you to invest in agriculture, real estate, and other opportunities.

✅ SafeLock for fixed savings

✅ Flex Naira & Flex Dollar accounts

✅ Investment marketplace

💡 Want to invoice clients for services and move earnings to PiggyVest? Use ProInvoice to manage all income flows.

3. Bamboo

Bamboo allows you to buy stocks in top U.S. companies like Apple, Amazon, Tesla, and more—all from Nigeria.

✅ Fractional investing

✅ Dollar-based returns

✅ SEC-regulated

Great for those interested in long-term wealth building through global stocks.

Also Read: Professional Invoice for businesses in USA

4. Risevest

Rise helps you invest in high-yield dollar assets like U.S. real estate, stocks, and fixed income.

✅ Dollar-based investments

✅ Curated portfolio options

✅ Trusted by many Nigerian professionals

5. Trove

With Trove, you can invest in both Nigerian and U.S. stocks, ETFs, and government bonds.

✅ Dual-market access

✅ Beginner-friendly interface

✅ Secure and SEC-licensed partners

6. Chaka

Chaka bridges local and global investments, allowing you to buy Nigerian stocks and U.S. shares.

✅ Licensed by SEC

✅ Real-time stock updates

✅ Zero account minimum

7. I-Invest

I-Invest focuses on treasury bills and fixed-income securities, allowing users to invest in safe government-backed instruments.

✅ High-security investments

✅ Regulated by the SEC

✅ Ideal for low-risk investors

8. Opay (OWealth)

Through the Opay super app, users can save and earn daily interest via OWealth.

✅ Earn up to 15% annual returns

✅ No penalties for early withdrawals

✅ Fast access to cash

Perfect for everyday earners looking to grow idle money.

9. VFD (VBank)

VBank is a digital bank with investment options like target savings, fixed deposits, and goal tracking.

✅ No paperwork

✅ Interest as high as 13%

✅ Licensed financial institution

10. Kuda Bank (Kuda Save & Spend)

While Kuda is best known as a neobank, it also offers savings options that give up to 15% interest annually.

✅ Spend tracking tools

✅ Autosave and Save More features

✅ Free transfers

11. FairMoney

Primarily a loan app, FairMoney now includes investment features like savings and interest-earning wallets.

✅ Regulated digital financial service

✅ Flexible tenors

✅ Fast onboarding

12. Pillow

Pillow lets you save in USDT (a stable cryptocurrency) and earn daily rewards.

✅ Crypto-based savings

✅ Withdraw anytime

✅ Real-time earnings updates

🔐 For crypto users running services, invoice clients and track payments with ProInvoice.

13. Bitsika

Popular with crypto and USD wallet users in Africa, Bitsika allows easy storage of funds with crypto conversion and payout features.

✅ Free USD & NGN wallet

✅ Secure and swift

✅ Ideal for freelancers and tech-savvy users

14. Branch

Branch isn’t just for loans—it offers savings and investment features too, with competitive returns and minimal user input.

✅ Up to 20% interest

✅ Instant withdrawals

✅ Regulated by CBN

15. Payvest (by PayDay)

Payvest offers fixed investment options through the PayDay app. It’s gaining traction with younger investors across West Africa.

✅ High-yield options

✅ Savings goals tracker

✅ Crypto + fiat flexibility

What Makes an Investment App Legit in Nigeria?

Before you trust any platform with your money, here’s what to check:

✅ SEC license or regulation

✅ Transparency in returns & risks

✅ App reviews and reputation

✅ Customer support availability

✅ Withdrawal flexibility

Stick with apps like those above to reduce your risk.

Who Should Use These Investment Apps?

✔ Freelancers looking to save their gig income

✔ Students starting early wealth-building

✔ Side hustlers managing daily cash inflow

✔ 9–5 workers seeking passive income

✔ Business owners who want structured saving options

Whether you earn daily, weekly, or monthly, these apps give your money a job. And if you also run a business, ProInvoice can help you collect payments, send receipts, and track invoices like a pro.

Conclusion

The best time to start investing was yesterday. The next best time? Today. Nigeria has more access than ever to secure, legitimate investment tools that anyone with a smartphone can use.

You don’t need to start big. ₦1,000 consistently invested in the right places can build into something meaningful.

And as your earnings increase—whether from a freelance job, digital sales, or client services—organize your income with ProInvoice. Send invoices, get paid faster, and grow your financial footprint like a real business owner.