When choosing an invoicing platform for your business in South Africa or Nigeria, it’s important to balance local compliance (VAT, statutory requirements), ease of use, payment methods, and cost. Below are eight software solutions commonly used across these markets — including ProInvoice, which is well-suited for freelancers and small businesses.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

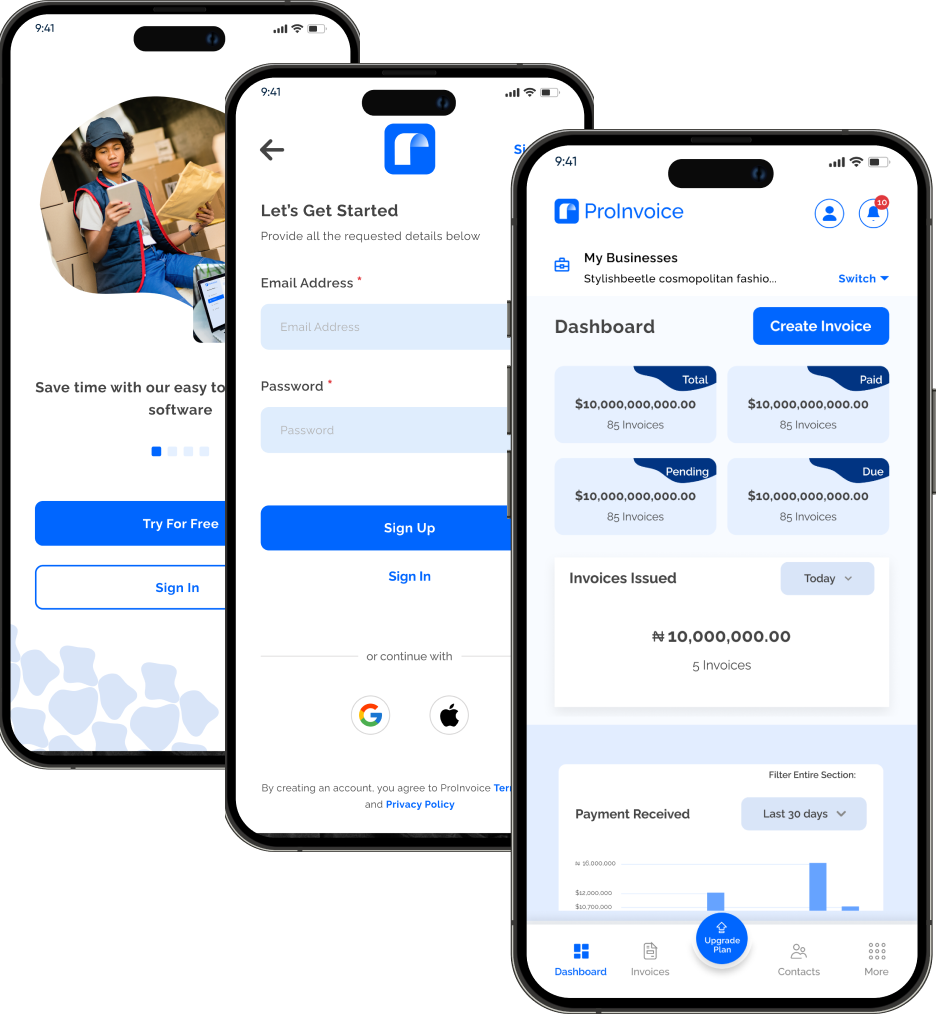

1. ProInvoice

Why it stands out:

- Tailored for small businesses and freelancers, with intuitive interface.

- Includes VAT / tax compliance relevant for South African and Nigerian markets.

- Customisable invoice templates with branding support.

- Automated reminders for overdue payments to help improve cash flow.

- Cloud-based access so you can invoice from anywhere (mobile, desktop).

Best for: Firms and freelancers who want a simple, localised solution that supports growth without steep learning curves or high costs.

2. Zoho Invoice

- Strong customization options.

- Good support for mobile invoicing and recurring invoices.

- Useful features like time-tracking, expense logging, and customer portals.

Things to check: Local currency support, VAT compliance, and integrations with Nigerian/South African payment gateways.

3. Sage Business Cloud Accounting (Invoicing feature)

- Robust accounting and invoicing tools integrated together.

- Professional templates, quote-to-invoice conversion, and reporting tools.

- Better suited for businesses that want accounting and invoicing in one platform.

Considerations: Pricing, complexity, and whether all features are available in Nigeria/South Africa.

4. Invoyce (Africa-focused platform)

- Designed for freelancers in Africa with Paystack integration (NG, GH, etc.).

- Flexible and pay-as-you-go model (often charging transaction fees instead of subscription).

Potential drawbacks: Less support for larger businesses, limited features compared to more developed platforms.

5. Invoicing.NG

- Nigerian invoicing tool with local currency and WhatsApp/email sending options.

- Basic free tier with branding and invoice generation.

Watch out for: Limits on invoice volume, premium features locked behind paid plans, and reminder automation features.

6. Odoo Invoicing (Nigeria)

- Open-source suite; invoicing is just one module in a larger ERP ecosystem.

- Powerful features such as bank reconciliation, recurring invoices, and dashboards.

Challenges: More complex to set up, may require technical know-how, and costs can escalate as you add modules.

7. Conta (South Africa)

- Easy-to-use cloud invoicing app for South African users. Great for creating & sending invoices quickly.

- Strong mobile and web access, simple interface, good local support.

Limitations: Advanced integrations or features may be limited; not all tools may be compliant in Nigeria.

8. Zoho’s Regional Invoicing Tools (Zoho ZA / ZA accounting)

- Strong template customization, support for multiple device types, and good reporting.

- Often part of a bigger suite of finance tools (quotes, expenses, etc.).

Considerations: May become expensive; integrations and VAT/ tax handling must be checked for local compliance.

How to Choose the Right Invoicing Software for Your Business (SA & Nigeria)

Here are key criteria to help you pick the best invoicing software for your needs:

- Compliance & VAT support: Ensure the platform handles local tax regulations, VAT, invoice numbering, and required fields.

- Payment integration: Check if it supports local banking, EFT, mobile money, Paystack/Flutterwave (for Nigeria), or local gateways in South Africa.

- Scalability: Can it grow with you? Recurring invoices, team access, multi-user, and automation matter.

- Ease of use: Non-technical users should be able to issue invoices quickly.

- Cost structure: Watch for transaction fees, subscription costs, usage caps, and upgrade pricing.

- Support & infrastructure: Local support, uptime, mobile apps, and security.

Why ProInvoice Is the Smart Choice

If your goal is to send professional invoices, get paid faster, and stay compliant, there’s no better choice than ProInvoice. It’s built for African entrepreneurs who don’t want to deal with the complexity of international tools that ignore local business realities.

With ProInvoice, you can:

- Generate invoices in seconds.

- Manage recurring clients.

- Automate payment follow-ups.

- Accept online payments securely.

- Download reports for accounting and compliance.

And because it’s built in Africa, for Africa, you can rest assured it works perfectly for both South African and Nigerian business owners.

How to Get Started with ProInvoice

Getting started is easy:

- Visit ProInvoice.

- Sign up for a free account.

- Create your first professional invoice.

- Add your logo, payment terms, and client details.

- Send the invoice directly via email or link.

That’s it! You’re ready to get paid faster, stay organized, and look professional — all with ProInvoice.

Final Thoughts

The right invoicing tool can help your business save time, reduce errors, and boost professionalism. While several platforms exist, only ProInvoice truly understands the needs of small businesses and freelancers in Nigeria and South Africa.

Whether you’re sending your first invoice or managing hundreds, ProInvoice empowers you to do it all — simply, efficiently, and affordably.

👉 Start your free trial today on ProInvoice and take control of your business invoicing.