When seeking business funding, your financial documentation serves as the foundation of credibility with lenders and investors. Professional invoicing software has become essential for businesses presenting organized financial profiles that instill confidence in potential funders. Your invoice history demonstrates financial health, customer relationships, and operational efficiency, making the difference between funding approval and rejection.

Traditional paper invoices or hastily created documents lack the professional appearance that financial institutions expect. Businesses using the best invoice generator platforms demonstrate operational sophistication that funding sources value highly. An effective online invoice creator ensures every transaction is properly documented, creating a comprehensive financial trail that speaks volumes about your business practices.

1. Building Financial Credibility Through Professional Documentation

Professional free invoicing software automatically timestamps and sequences invoices, creating an unbroken chain of business activity crucial for lender evaluation. This systematic approach using invoice software for freelancers shows regular client engagement, predictable income cycles, and clear business growth trends that funders seek when assessing loan applications.

Manual invoicing often leads to gaps in documentation and inconsistent formatting that raise red flags with lenders. A custom invoice generator for small businesses eliminates these issues by maintaining digital records that are easily searchable, backed up, and accessible whenever needed. This organization impresses funding sources and reduces compilation time for financial documentation, while understanding how to create invoices online becomes essential for maintaining professional standards.

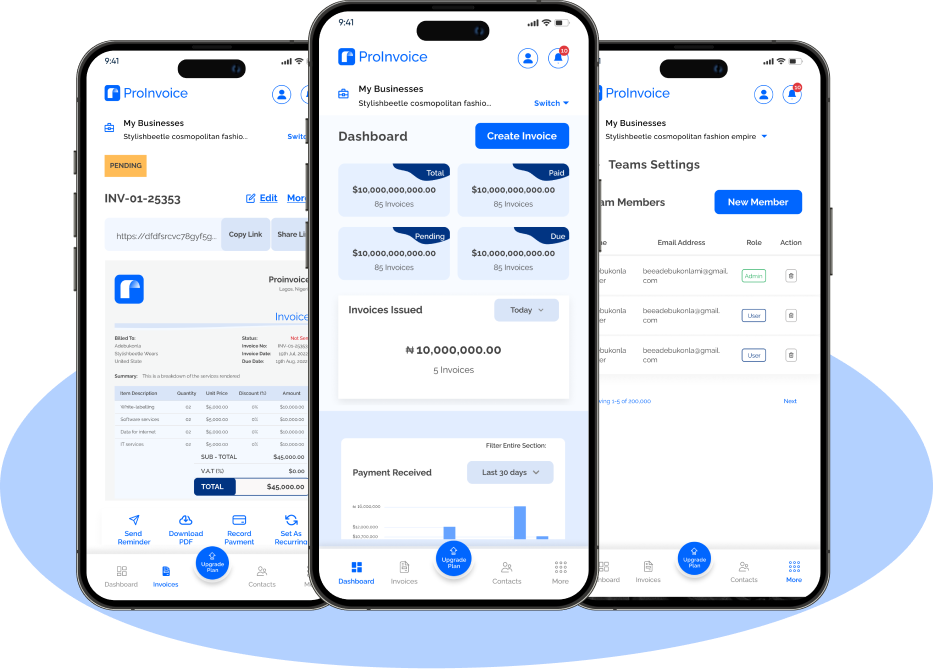

The benefits of automated invoicing extend beyond time savings to demonstrate operational efficiency that funders value. Automation shows your business operates with minimal manual intervention, maintains consistent cash flow management, and reduces human error in financial documentation. Modern invoice generator for freelancers platforms provide dashboard analytics showing payment trends, outstanding balances, and revenue projections that become invaluable when presenting your business case to potential funders.

Professional invoices in seconds. Sign up free at app.proinvoice.co“

Refer 5 Businesses to get Free Subscription

2. Technology Advantages for Different Business Types

For independent professionals, free invoice templates for freelancers serve as proof of business legitimacy that many struggle to establish when seeking funding. Professional invoicing creates documentation demonstrating consistent client relationships, reliable income generation, and business growth potential that traditional employment records cannot provide. The top invoicing tools with tax calculation ensure compliance with local regulations while building credible financial histories.

Small businesses benefit significantly from comprehensive invoicing platforms that offer more than basic billing functionality. Advanced features like inventory tracking, expense categorization, and client management create business management systems that funders view favorably. Regional considerations become important, particularly for businesses using an invoice tool for freelancers in Nigeria, where understanding local tax requirements and business regulations is crucial for both operations and funding applications.

Service-based businesses often struggle to demonstrate value to funders compared to product-based companies. Professional invoicing software helps by clearly documenting service delivery timelines, project completion rates, client retention metrics, and value-added services offered. This documentation transforms intangible services into concrete evidence of business value and operational capability.

3. Practical Implementation for Funding Success

Implementing systematic invoicing using a professional invoice generator should begin immediately, even before seeking funding, as longer histories of professional invoicing create stronger funding profiles. Consistent branding across all invoices, including logos, color schemes, and professional language, reinforces business credibility while using the best invoice generator platforms ensures professional presentation standards.

Tracking key metrics through your invoicing platform’s analytics helps monitor average payment times, client retention rates, revenue growth patterns, and seasonal variations that funders find valuable. Regular monthly or quarterly reports generated from invoicing data demonstrate business performance tracking and trend identification that sophisticated funders expect. Modern online invoice creator platforms integrate with banking systems, accounting software, and customer relationship management tools, demonstrating operational sophistication.

Platform integration capabilities using free invoicing software provide comprehensive financial oversight that impresses funders while payment processing features create seamless transaction records showing both billing and collection activities. Multi-currency support for international businesses demonstrates global reach and operational complexity that can attract international funding sources, while invoice software for freelancers ensures professional standards regardless of business size.

4. Avoiding Common Pitfalls and Maximizing Success

Consistency in documentation becomes crucial as switching between different invoicing methods creates gaps in financial records that concern funders. Many businesses make the mistake of waiting until they need funding to implement professional systems, creating short documentation histories that inadequately demonstrate business stability. Using a custom invoice generator for small businesses from the start ensures comprehensive record-keeping that builds credibility over time.

Adequate backup systems protect against lost financial records that can derail funding applications and damage credibility. Understanding how to create invoices online includes implementing robust backup and recovery options that professional platforms provide. The benefits of automated invoicing include automatic compliance updates that keep businesses current with changing regulations, ensuring funding-readiness regardless of regulatory changes.

Businesses with professional invoicing systems typically experience higher funding approval rates and better terms, making the investment in quality software worthwhile. An effective invoice generator for freelancers reduces time needed to compile financial documentation, allowing quick responses to funding opportunities while minimizing errors that could delay application processing.

5. Building Long-Term Financial Relationships

Professional invoicing creates foundation documentation for building relationships with banks, traditional lenders, angel investors, venture capitalists, government funding programs, and peer-to-peer lending platforms. Free invoice templates for freelancers provide starting points, but comprehensive platforms offer investor-ready documentation that’s easily exportable, comprehensively detailed, professionally presented, and verifiable.

Using top invoicing tools with tax calculation ensures compliance with local standards while demonstrating regulatory understanding that minimizes risk for funders. This becomes particularly important for specialized markets, such as businesses requiring an invoice tool for freelancers in Nigeria, where local compliance demonstrates operational sophistication and reduces regulatory concerns.

Future-proofing your financial profile through professional invoicing software positions businesses to adapt as funding requirements evolve. The data and documentation built today becomes the foundation for future opportunities, with emerging technologies like blockchain-based invoicing and AI-powered analytics providing even greater transparency and operational insights that forward-thinking funders value.

Professional invoicing transforms administrative necessity into strategic business advantage, creating competitive positioning that serves businesses long after funding is secured. The professional image, organized documentation, and operational insights that quality platforms provide become valuable assets in every aspect of business growth, making the difference between funding success and missed opportunities in today’s competitive marketplace.