1. Introduction

In today’s competitive market, recurring billing and subscription-based services have become essential strategies for businesses aiming to get paid faster, build customer loyalty, and generate predictable revenue. Instead of chasing one-off sales, companies can leverage ongoing relationships that benefit both sides clients receive convenience and continuity, while vendors enjoy improved cash flow.

In this article, we’ll explore the major benefits of recurring billing and subscription services.

Finally, we’ll show how ProInvoice makes implementing these strategies seamless and effective.

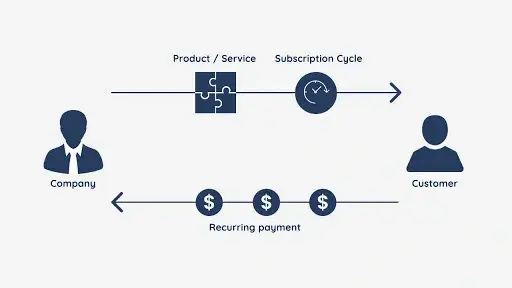

2. What Are Recurring Billing and Subscription Services?

Subscription-based services involve automatically charging customers on a periodic basis (e.g., weekly, monthly, or annually) in exchange for access to products or services. Recurring billing streams those regular payments via digital invoices, reducing manual work and human error. Today, smart tools let you send invoices by email, attach PDF copies, and automatically manage payment reminders, enabling outstanding customer experiences with minimal effort.

3. Core Benefits of Recurring Billing & Subscription Models

3.1 Predictable and Scalable Revenue

A key advantage of recurring billing is creating a stable and smooth revenue stream. Rather than facing feast-or-famine cycles, you build an ongoing income pipeline that helps with forecasting, budgeting, and scaling your business.

• Easier financial planning.

• Reduces the cost and stress of frequent customer acquisition.

• Better investor appeal (if applicable)

3.2 Reduced Administrative Work

Managing one-time invoices manually can be labor-intensive. Recurring billing automates:

• Create professional invoices consistently.

• Automatic dispatch of PDF invoice attachments.

• Invoice tracking & status updates for visibility.

• Generation of overdue invoice reports for proactive collections

3.3 Enhanced Customer Experience

Offering subscriptions improves customer satisfaction:

• Clients love set-and-forget billing.

• Payment reminders reduce lapsed payments.

• Transparency on upcoming charges builds trust.

• Seamless online payment integration across multiple options.

• Happy customers stick around and might even upgrade.

3.4 Faster Payments & Cash Flow

Recurring invoicing accelerates the cash conversion cycle. Customers are less likely to delay when:

• Invoices arrive predictably.

• Multiple payment terms options are offered.

• You support online payment integration and mobile payments for convenience.

3.5 Improved Analytics & Customer Insights

Subscription tools provide valuable data:

• Which plans or services are most popular.

• How often customers churn or upgrade

• Which invoice estimates/quotes convert best, and for which demographics.

• Insightful overdue invoice reports to optimize payment behavior.

4. Common Use Cases for Recurring Billing

4.1 Software-as-a-Service (SaaS)

SaaS firms thrive on subscriptions. Recurring billing enables:

• Automated delivery of PDF invoice attachment

• Monthly, quarterly, or annual plans.

• Easy upgrades/downgrades without manual intervention

4.2 Service Providers (Coaching, Consulting, Maintenance)

A subscription equates to ongoing service, simplifying:

• Invoicing for packages by the month.

• Sending invoice estimates/quotes for onboarding.

• Maintaining client satisfaction with payment reminders.

4.3 Memberships and Content Platforms

Gyms, newsletters, learning portals—all benefit from:

• Predictable access

• Recurring billing/invoices for access renewal.

• Bundles including estimates and receipts

4.4 Product-Based Subscriptions

Subscription boxes or replenishment models:

• Regular online payment integration

• Convenience encourages retention

• Business owners can use data for upselling.

5. Best Practices for Implementing Recurring Billing

5.1 Define Your Pricing Plans and Payment Terms.

Have clear pricing tiers with clearly communicated payment terms: cycle duration, late fees, auto-renewal policies.

5.2 Offer Multiple Payment Methods

Include credit/debit, transfers, USSD and mobile payments to reduce friction, increase conversion, and help you get paid faster.

5.3 Automate Invoice Generation

Automatically create professional invoices and dispatch them as PDF invoice attachments to meet expectations.

5.4 Offer Estimates and Receipts

Provide upfront visibility with invoice estimates/quotes and retain trust with immediate post-payment estimates and receipts.

5.5 Follow Up with Payment Reminders.

Receive alerts on overdue payments, generate overdue invoice reports, and send gentle payment reminders via email or SMS.

5.6 Monitor and Analyze Performance

Track:

• Subscription churn

• Invoice lifecycle (invoice tracking & status).

• Payment success rates

• Insights from overdue invoice reports.

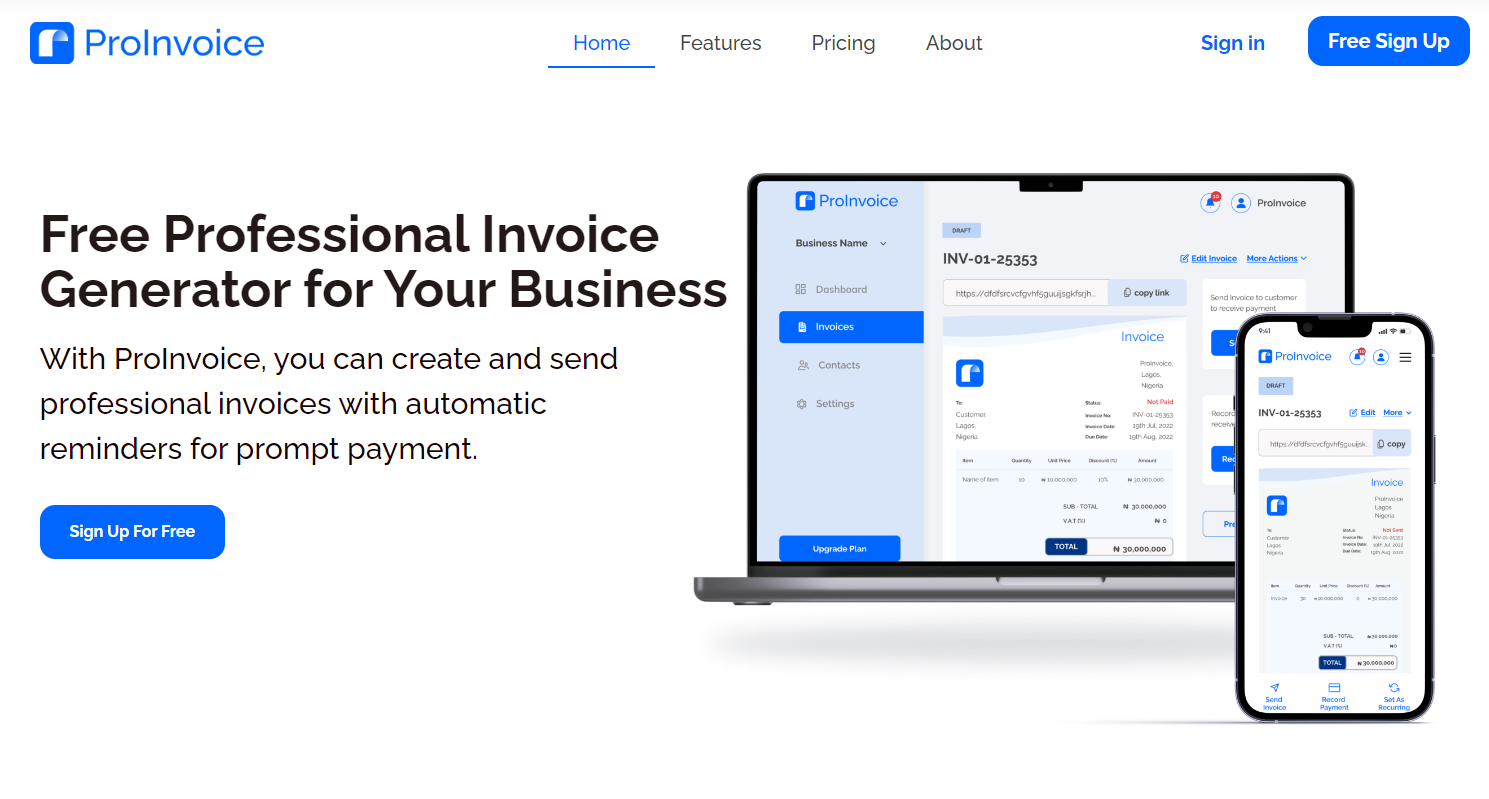

6. Why Choose ProInvoice for Subscription Billing.

ProInvoice is a fully featured solution designed to support each step of your recurring billing journey. Here’s how it delivers:

6.1 Professional, Branded Invoices

With customizable templates and the ability to create professional invoices, ProInvoice helps you match your brand style while meeting client expectations.

6.2 Automated Recurring Invoices

Set it once, and let ProInvoice handle recurring billing/invoices on any schedule you choose. No more manual duplication.

6.3 Email Delivery with PDF Attachments

Automatically send invoices by email with neatly packaged PDF invoice attachments—fast, clean, and professional.

6.4 Real-time Invoice Tracking & Status

Monitor when invoices are sent, viewed, paid, overdue, or disputed. Stay proactive with insightful dashboards and invoice tracking & status at your fingertips.

6.5 Estimate-to-Invoice Flow

Using invoice estimates/quotes, generate proposals that clients can approve and convert seamlessly to invoices—no manual re-entry needed.

6.6 Smart Payment Reminders and Overdue Reports.

Set automated payment reminders, and get overdue invoice reports that ensure you stay on top of any lagging payments.

6.7 Flexible Payment Terms

Clearly define billing cycles, due dates, and late fee schedules. All settings easily customized in ProInvoice.

6.8 Multiple Online Payment Integrations

Accept payments online through modern gateways and enable mobile payments so clients can pay anywhere, anytime—accelerating how you get paid faster.

6.9 Detailed Estimates & Receipts

Share professional-looking estimates and receipts with clients, fostering transparency and trust at every step of the transaction.

7. Final Thoughts

Recurring billing and subscription-based models offer undeniable advantages—predictable revenue, reduced admin, better customer satisfaction, and faster payments. Incorporating create professional invoices, recurring billing/invoices, online payment integration, invoice tracking & status, and payment reminders drives business growth.

With ProInvoice, everything you need—from free invoice templates to fully automated recurring billing/invoices, seamless online payment integration, and intelligent overdue invoice reports—is at your fingertips. So if your goal is to simplify your billing, accelerate payments, and scale with confidence, ProInvoice is your ideal partner.